There’s money in your commercial property, but do you know how to claim it?

Capital Allowances Commercial Property

We love unlocking hidden money in our clients’ commercial property.

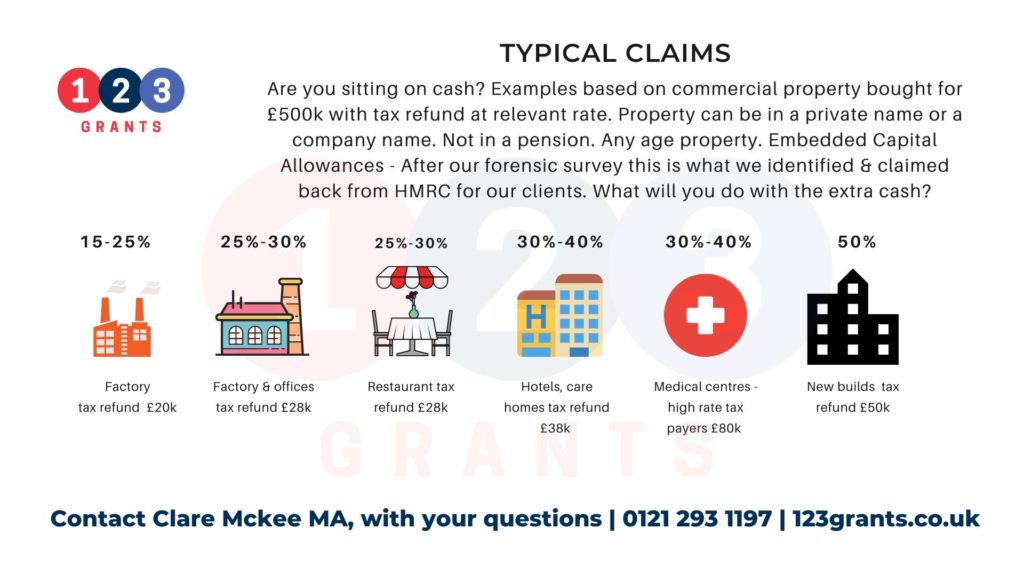

It can be any type of commercial property. It can be in your name or a company name. We can’t claim if it’s in a pension pot though.

Recently, we have helped these companies make a claim. We do it all for you, full forensic survey, detailed costing and apportionment and submitting the claim. We’ll also answer any queries from HMRC too. Don’t leave money on the table.